If anyone is determined by you fiscally, acquiring the most effective life insurance for the scenario is vital. Forty-four per cent of U.S. households would confront financial hardship in just six months if the key wage earner died—and for 28%, it would be just one thirty day period—In accordance with LIMRA, an business-funded research business. Life insurance is one way to swap your revenue for those who die unexpectedly.

Protection quantity increase requests require evidence from the qualifying life occasion but tend not to require a new application, health care examinations or tests, or a brand new healthcare questionnaire. With the overall health standing freeze function, the new enhanced protection quantity will be rated at the age and health and fitness standing with the insured at the time from the initial plan application. Protection amount of money lower are issue to Progressive Life's minimum protection amount.

Previous to covering insurance, Michelle was a lifestyle reporter for the The big apple Daily Information, a magazine editor masking buyer technological know-how, a international correspondent for Time and many newswires and local newspaper reporter.

** If you qualify for adaptable term life insurance, your age and wellbeing status will "freeze" at time you buy your plan. So should you improve your protection volume for any covered life party in the initial ten years of the policy, your fee will never increase due to your age or any health problems that developed given that you obtain the coverage.

Advisors offering IUL may well tout insurance policies dependant on the rosy pictures painted in policy illustrations. Illustrations usually focus on non-assured features from the policy, for instance income worth gains and loans towards income worth that seem like they won’t Price anything at all.

PAA gets payment from eFinancial or its affiliate which will change determined by the volume of apps taken by eFinancial as well as coverage you purchase. Speak to us for more particulars.

Acquiring your own private life insurance policy offers Management and flexibility. Guidelines via operate might be minimal, and you may get rid of coverage if you change Employment.

Life insurance will let you have a lot more control of the amazing and challenging things that life features. It may also help Develop your fiscal self esteem, knowing that life insurance Your loved ones’s future is protected. Find the correct life insurance Resolution

Furthermore, this rider permits the term plan to generally be converted to your lasting plan with no need a clinical Examination.

The Demise benefit can also be affected by particular plan provisions or activities. As outlined before, unpaid policy financial loans (which include accrued curiosity) reduce the Dying benefit dollar for greenback.

Regardless of whether you’re navigating little one-rearing years or tackling home finance loan commitments, term life might be a reassuring basic safety Internet. Bankrate’s insurance editorial group breaks down term life insurance to assist you superior comprehend if this coverage type is best for your needs.

No matter whether you're a college student, a federal worker, or even a member of the armed forces, GEICO has a reduction it's possible you'll qualify for.

Then again, a childless couple with 10 years left on their own mortgage loan might only need a term life insurance plan being Energetic even though they are still spending off their residence.

Whilst employer-offered life insurance is beneficial, It is usually constrained and might not be adequate to include all Your loved ones's desires. Owning an extra own plan makes certain you have suitable protection, even if you switch Employment or retire.

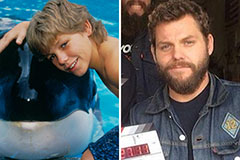

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!